Insights & Opinions

The Future of Work in the Banking Industry

Mon, 27 Apr 2020

The most significant impact for any banker in this crisis today is in the way their working conditions changed. So, on April 23, we invited Guy Claes at The Banking Scene Afterwork to discuss everyone’s experiences and opinions on the future of work, with particular attention to the future of remote working. Guy Claes is the Marketing Director of Facilicom Group, a facilities company. His open mind and fresh look at the banking industry created the perfect setting for a very open discussion.

So first, thumbs up for Guy for his involvement in our Afterwork! His insights were a big contribution to the dialogue and an inspiration for all of us! It provided the right context for the news about exit plans on April 24 and the following days.

The Banking Scene Afterwork: remote or physical?

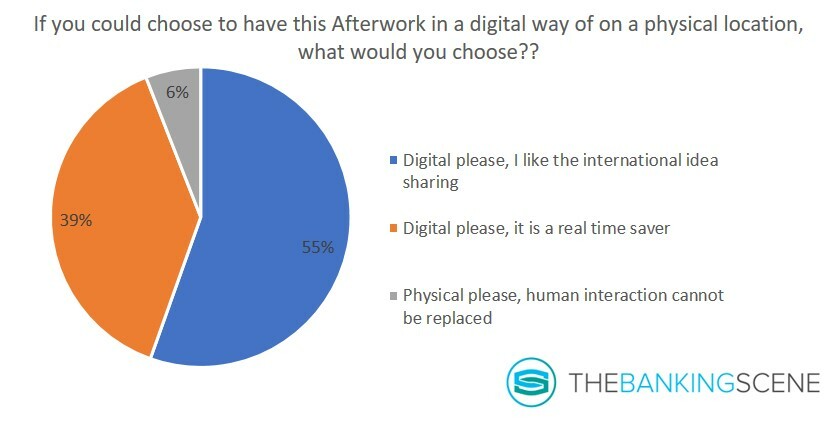

A first warming up for the session was a poll on whether the attendees (27) prefer the concept to be digital or physical. Luckily, it confirmed that we found the right setting for this kind of discussions:

Small remote meetups do provide the right context for short in-depth discussions. Suddenly it becomes acceptable to have these short meetings without any waste of time for transportation. As these meetings are easily accessible, we can add an international flavour on it, without demanding people to fly over.

In our setup, every participant has an hour to grow his/her network and to have more bilateral discussions afterwards if he/she likes. One consequence is that the sessions perhaps are more effective if they take longer. If needed, we can always schedule a second Afterwork later on, just let me know!

COVID-19 and the true appreciation of remote working, but more balanced, please

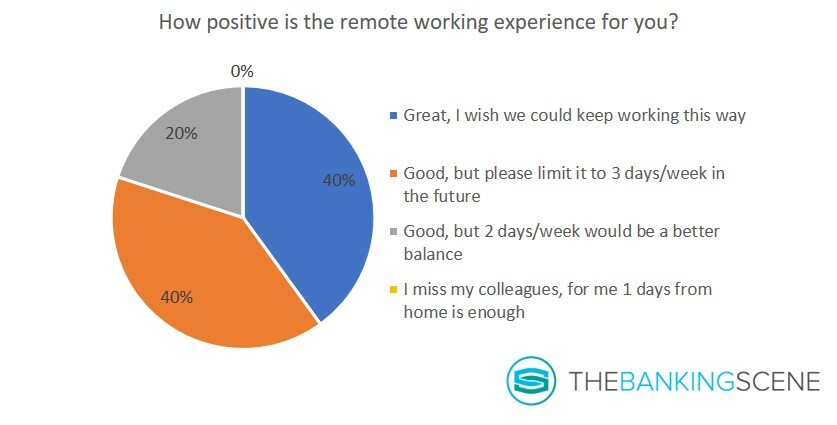

Our second poll showed, in general, that remote working is a positive experience, although the vast majority would appreciate a more balanced approach. 2–3 days/week is preferred over the full-time or no-time home working.

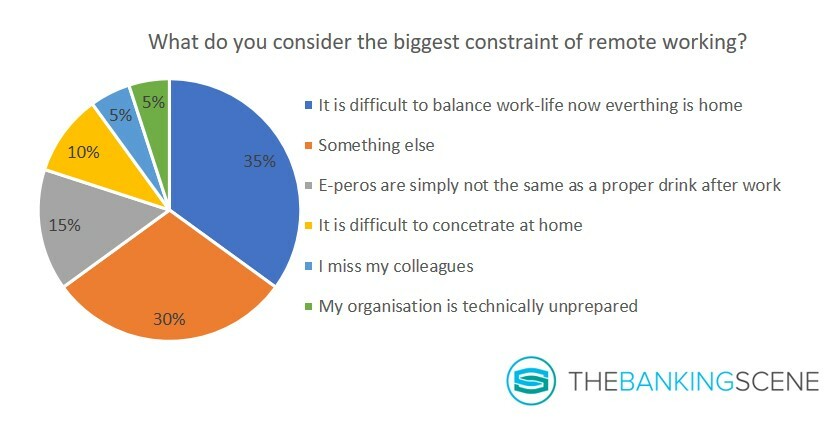

The main challenge of home working today (see image 3 below) is the work-life balance: now that everything takes place at home, it is difficult to switch the internal button from work to home and back again. When schools reopen, this may rebalance again, because at least it will be possible to block working hours to concentrate on your professional activities without being interrupted by private coincidences (although the recent exit-plans indicate that Belgium is still far from having all kids at school).

COVID-19 and the call for true leadership

On the question what the audience considers the most significant constraint of remote working, ‘Something else’ scored a second position. One of the reasons being the culture and trust in the employees that are sometimes lacking to fully enjoy a more flexible way of working. COVID-19 will clearly have a positive impact here: the situation is proving to the traditional manager that working from home makes sense.

A bank executive made an excellent point that in these days, authentic leadership drives a good organization, today even more than yesterday.

People who can work autonomously and who take care of themselves are more productive today than ever before. True leaders make sure that their teams are not only doing the job they should do but also make sure they do, it in a mentally healthy way.

Taking care of yourself in this context also means saying ‘no’ every once and a while. If not, you get involved in all kinds of calls and meetings that simply consume energy. You cannot concentrate on a screen for a full day. This constraint requires another way of working.

Choose your own breaks: this other way of working means that you need to free your mind every now and then, which sometimes seems impossible with calls from early morning to late in the evening. Again: autonomy has become a vital skill.

The conversation also continued to how, in a remote environment, an organization should evaluate its employees. It has become impossible today to do this based on the number of hours in the office (if it ever was a right KPI for evaluations). As a manager, trusting your team and setting expectations on output instead of working hours is the only reasonable way forward these days. Of course, that is: in a fair sense of structure and respect for your colleagues’ productive hours.

Are the expectations not fulfilled? Talk to your team member, see if training can help or another way of working perhaps, or more breaks? Blocking time slots in your diary for a break is critical to keep your workday balanced and productive. This way of thinking requires a complete shift from the traditional way of managing a team.

This may be more challenging for operations departments that are used to having a repetitive job in the office from f.e. 09:00 a.m. to 04:30 p.m. These people are less concerned about the necessary breaks for creative thinking, or proper management of the dairy for team meetings. Their main concerns are:

- Do I have the right infrastructure at home?

- Will I be compensated for my internet connection?

- How do I do administration remotely?

COVID-19 and the reappreciation of cleaning services and security people

Currently, nobody knows when offices can reopen. Rumours talk about mid-May, but this remains uncertain until we have an official date to organize ourselves (this session was one day before the famous press conference in Belgium on the exit strategy).

One of the upsides of today’s crisis is an upgrading of sectors like the hygiene business. Until a few months ago that was a job to be done after working hours. Cleaners were not considered to be part of the core business. They were supposed to come to the office after office hours, to avoid any disturbance of the day-to-day business. With COVID-19, they will be reappreciated because hygiene continuity will determine business continuity.

The same is true for the security industry. Security will become more important, not just at the entrance but also IN the office to control social distancing. These people stood on the sideline for many years. Now, we’ll be happy to have them around us, a proof that we work in a healthy environment.

COVID-19 and the call for a redistribution of office space

Cushman & Wakefield published a report where they argued for an add-on of 1,5 m radius per workspace. Today, pre-corona, the law states that every employee needs a minimum between 7 square metres and 10 square metres. The suggestion of Cushman and Wakefield would bring this to somewhere between 14 square metres and 16 square metres per employee. Keep in mind that this is not a short-term measure, but it anticipates on other future pandemics. It will completely change our office experience.

For the Netherlands, calculations are showing that implementing this suggestion would result in a shortage of workspaces of 1,2 million m2, meaning that companies need to look for alternatives, one of which being working from home, but also flex offices and co-working spaces (no number available for Belgium).

Today 75% of all Belgian offices are in Brussels, or 13 million m2. In Flanders, 55% of offices can be found in Antwerp, an equivalent of 2,3 million m2. This concentration isn’t healthy, and we know that already a long time. It slowed down traffic before COVID-19 and it is the biggest health risk when the economy goes up again. Essentially it means that is it nearly impossible to easily isolate just a small part of the economy. For a country like Belgium, it is all or nothing, simply because we are too dependent on two major cities.

Jo Caudron understood this already for some time:

we need to bring office space closer to housing again. Redistributing office space to every city and village is the only viable, sustainable way forward. The era of concentration of offices in a few cities is over. The impact is enormous:

- Less traffic

- Less dense public transport

- Better work-life balance

- Lower risk in a new pandemic

- …

Many big corporates see the current crisis simply as an acceleration of something that already started years ago: the headquarters will have fewer desks in the future. Their workforce will work more from home, at flex working spaces and on other remote locations, like for example, co-working space. Who knows… perhaps this crisis may be the resurrection of WeWork?

A new role for offices

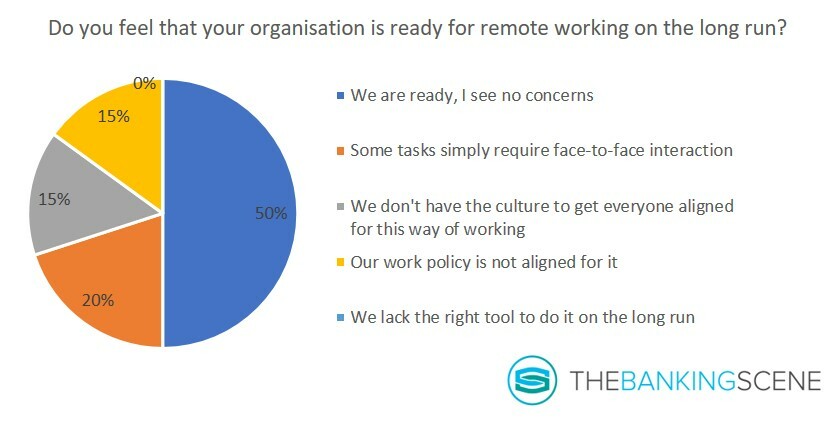

Offices will remain important! Meanwhile BNP Paribas Fortis shared their short-term plans to reopen their offices in Brussels. The idea is that people can come back every one in three weeks for more team cohesion, social contacts, and more involvement.

What COVID-19 did not change is the need for human interaction. People are social creatures. This will change the role of the office. The crisis shows we don’t need an office to work, but we do need the office for social cohesion, for corporate culture and identity. Working in an office for 40–60 hours/week is over. Visits to an office will be more ad hoc in the future.

Thanks to digital solutions and technology, we can now work everywhere. Yes, we can also meet everywhere, but by now I think all of us understand that a Zoom meeting is not the same as the real thing.

This social role of the office will also have a big impact on how we work in the future, and it may also trigger a new wave of innovation at big corporates. Being locked in your own office means that new ideas come upon invitation. When you’re no longer locked in your own office, you meet new people, new corporate cultures, new ideas and partnerships (I don’t have to convince the start-ups about this, don’t I?).

How will customer service look like in branches?

Like COVID-19 is the biggest POC in the history of remote working, so is it the biggest POC in digital customer service for banks. All banks are forced to do it, and by looking at all the learning from different banks and their different approaches, digital banking will accelerate, also for consumers that were very reluctant to digital services in the past.

That is not only true for payment solutions, but it is also the case for the more complex financial products. Perhaps organizations will now better understand the true meaning of digitalization. Agreed, in Belgium and the Netherlands digital bank customers are spoiled, but digital banking is still very often just lipstick on a pig.

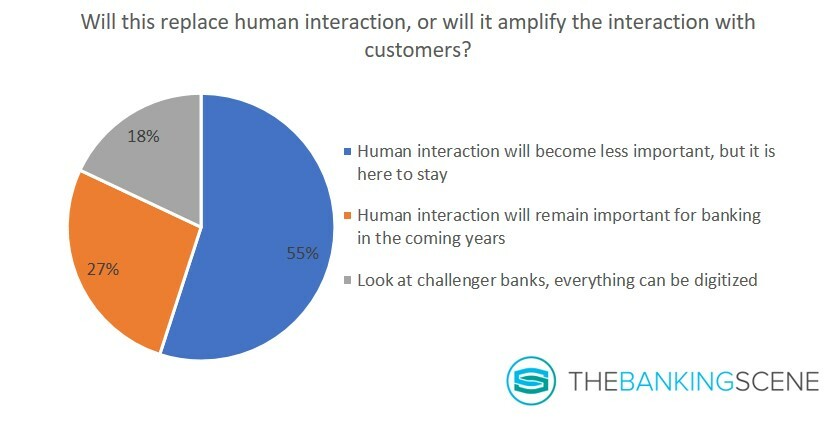

Don’t take this too black or white: most of the participants agreed that the human connection and interaction would remain a critical point, especially for the more emotional interactions.

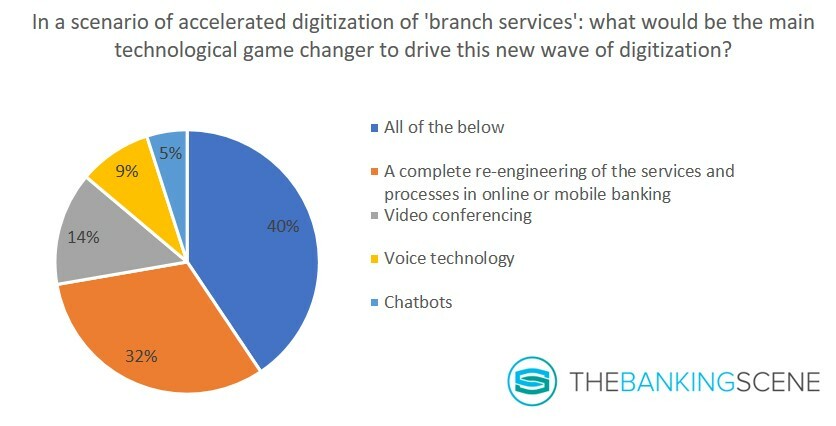

The impact of AI and voice technology will be a key technology in the next wave of digitization. Guy: “Enabling the right technology to deliver, is one of the most important things today. Your customer is always right. He has his expectations, his ideas of what the experience should be, and every bank has the challenge today to meet that experience.”

This also means of course that when digitizing services, it should not end up in stripping services to a cold product offer. Digital bank should evolve from ‘serving the poor’ to ‘serving all at a higher level’. This came from a banker by the way 😉.